Helping Companies Hire The Best Drivers FAST... Guaranteed!

Take control of your perfect recruiting process to consistently grow your fleet without relying on crowded job boards or expensive recruitment agencies.

Helping Companies Hire The Best Drivers FAST... Guaranteed!

Take control of your perfect recruiting process to consistently grow your fleet without relying on crowded job boards or expensive recruitment agencies.

Download Our Rocket Recruiting Template

Easy 4 Step Roadmap To Double Your Fleet in 2025

Download Our Rocket Recruiting Template

Easy 4 Step Roadmap To

Double Your Fleet in 2024

Customers Who Use Us

Customers Who Use Us

Access The Entire

Driver Pool

No more relying only on the job boards. Easily access all the drivers in your market by launching ads in minutes that have been proven to work and generate over 80,000 leads.

"It's been just 1 week and we already have 4 interviewed drivers with confirmed interest including a lead driver with 7 others pending in the Savannah area."

Logan P.

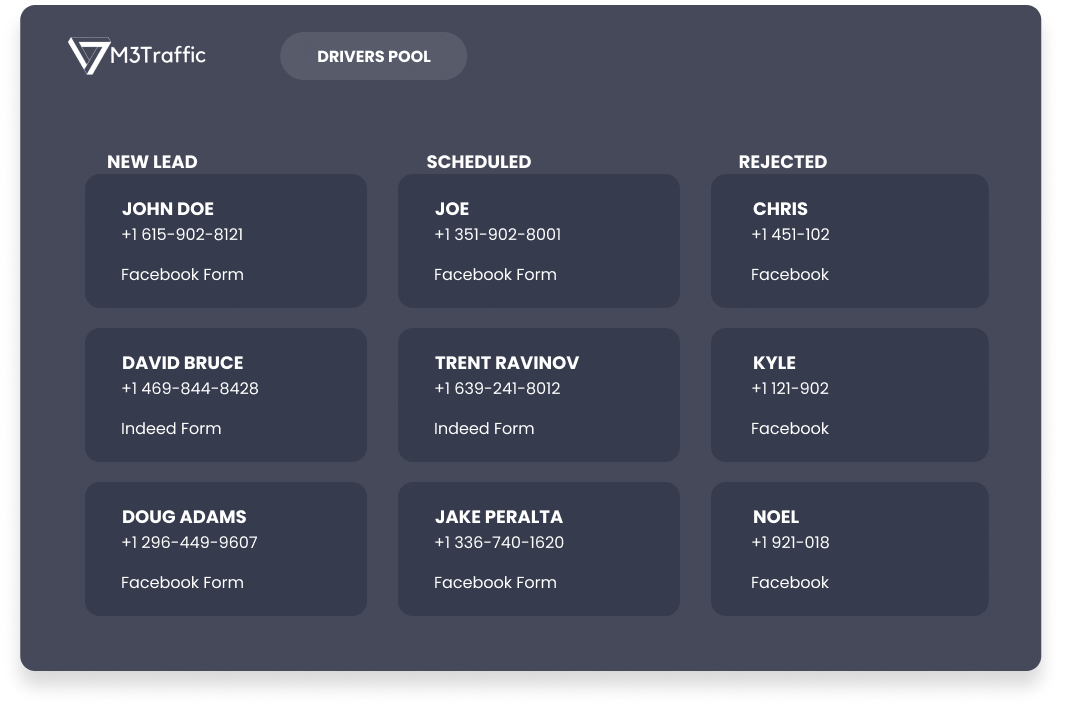

Save Time and Focus On Qualified Candidates

Reduce wasted time on unqualified candidates by filtering them out and instantly engage with your qualified candidates. The largest processor of driver applications did a study to find that you are 30% more likely to hire a driver if you respond within 5 minutes. Qualified applicants will show up on your calendar asking you to call them and give them an interview.

“With your system, it does it for us, making our job a little easier. We couldn’t keep up with all the candidates we have without your follow up system. Most of our tenured drivers are because of your follow up system."

Jasmynn F.

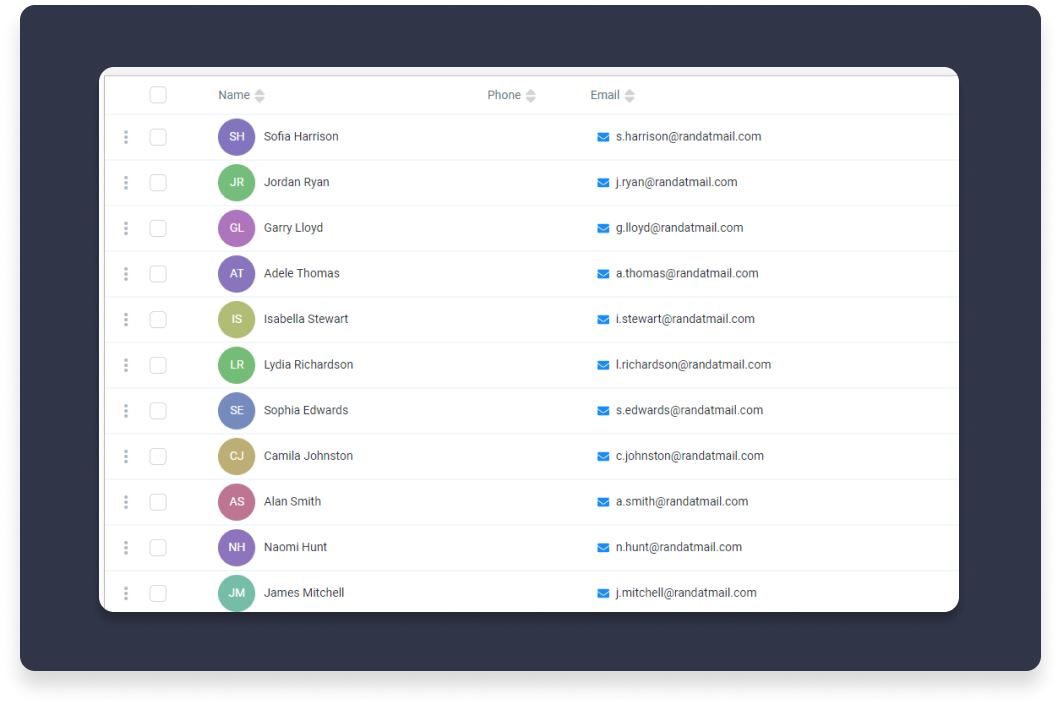

Lower Your Cost Per Hire by Building Your Waitlist

As the saying goes, fortune is in the followup.

By building your own company database of drivers and storing it in your system, you have permission to message them at will free of charge because you own this database. Next time you need to fill a position, use your own database rather than relying on someone else’s advertising platform or a crowded job board.

“Robert had a list of 300 drivers built up in his waiting list. Using ALIS, he sent out a message to them and had 25 interviews scheduled almost instantly for free and filled his position in 2 days. "

Access The Entire

Driver Pool

No more relying only on the job boards. Easily access all the drivers in your market by launching ads in minutes that have been proven to work and generate over 80,000 leads.

"It's been just 1 week and we already have 4 interviewed drivers with confirmed interest including a lead driver with 7 others pending in the Savannah area."

Logan P.

Save Time and Focus On Qualified Candidates

Reduce wasted time on unqualified candidates by filtering them out and instantly engage with your qualified candidates. The largest processor of driver applications did a study to find that you are 30% more likely to hire a driver if you respond within 5 minutes. Qualified applicants will show up on your calendar asking you to call them and give them an interview.

“With your system, it does it for us, making our job a little easier. We couldn’t keep up with all the candidates we have without your follow up system. Most of our tenured drivers are because of your follow up system."

Jasmynn F.

Lower Your Cost Per Hire by Building Your Waitlist

As the saying goes, fortune is in the followup.

By building your own company database of drivers and storing it in your system, you have permission to message them at will free of charge because you own this database. Next time you need to fill a position, use your own database rather than relying on someone else’s advertising platform or a crowded job board.

“Robert had a list of 300 drivers built up in his waiting list. Using ALIS, he sent out a message to them and had 25 interviews scheduled almost instantly for free and filled his position in 2 days. "

Join the One Driver Away Challenge Today!

Ready to hire your next great driver? Take the challenge for only $99 – Pay once, and get lifetime access to the proven system that will help you recruit drivers quickly and efficiently. No more guesswork, no more wasted time.

Frequently Asked Questions

Is advertising spend included?

No, the budget that you’d like to allocate to any advertising platform will be separate. The budget you will spend to hire a driver will vary widely depending on a number of factors. For you to estimate, we usually see lead costs ranging from $3 - $20 per lead using adlaunch pro.

Can you manage the advertising for me?

Yes, we do have an option to manage the advertising budget for you and maximize the number of leads you get. This is an option if you have an ad budget exceeding $3,000 per month. Schedule a demo and we can discuss exactly how that works and see if you are a good candidate for that.

I already use Tenstreet, driver reach, or another ATS. Can I use this?

Congratulations on having a system that you use. We have various options of integrating with driver reach and tenstreet or other platforms depending on your need. Schedule a demo and we can walk through the best option for that.

Is there a long-term contract?

No long term contracts. We operate on a basis where we make sure that you are happy. If it’s not working for you, you are able to cancel with a written 30 day notice.

Latest Blog Posts

Factoring Unpacked: Cash Flow Strategies, Types, and Success Stories

Factoring Unpacked: Cash Flow Strategies, Types, and Success Stories

In this detailed discussion, Mitch welcomes Tina Capobianco to delve into the intricate world of factoring. Despite its commonality, this topic is explored beyond its basics, offering valuable insights into the sale of accounts receivable.

Tina succinctly explains the fundamental concept: businesses sell accounts receivables to factoring companies to maintain cash flow while waiting for customer payments. She emphasizes that factoring does not incur debt but instead is an asset sale.

2 Types of Factoring

Full Recourse Factoring means that if the factoring company cannot collect the receivable within a set period (e.g., 90 days), the client must repay the advance, likening it to a short-term loan.

Non-Resource Factoring offers a credit guarantee, removing the client’s risk if a customer defaults or becomes insolvent.

Factoring vs. Bank Financing

While bank financing may come at a lower interest rate, factoring offers several unique advantages. Factoring is accessible even to startups and businesses without a long financial history, focusing on the quality of receivables instead of credit history.

Moreover, factoring companies often provide additional services like collections and credit checks, acting as an outsourced accounts receivable department. This can actually end up savings on costs if you can reduce staff on your team.

Choosing a Factoring Partner

Selecting the right factoring partner involves more than just considering rates. Here’s a handful of things to look for:

Longevity in the business

financial stability

transparency

service offerings

no hidden costs

check for references

The Road to Success with Factoring

Tina’s discussion highlighted a compelling success story of a two-truck operation growing to 450 trucks with the help of factoring. This demonstrates how, with the right partner and strategy, factoring can transform a business’s financial landscape, enabling growth and stability.

Latest Blog Posts

Factoring Unpacked: Cash Flow Strategies, Types, and Success Stories

Factoring Unpacked: Cash Flow Strategies, Types, and Success Stories

In this detailed discussion, Mitch welcomes Tina Capobianco to delve into the intricate world of factoring. Despite its commonality, this topic is explored beyond its basics, offering valuable insights into the sale of accounts receivable.

Tina succinctly explains the fundamental concept: businesses sell accounts receivables to factoring companies to maintain cash flow while waiting for customer payments. She emphasizes that factoring does not incur debt but instead is an asset sale.

2 Types of Factoring

Full Recourse Factoring means that if the factoring company cannot collect the receivable within a set period (e.g., 90 days), the client must repay the advance, likening it to a short-term loan.

Non-Resource Factoring offers a credit guarantee, removing the client’s risk if a customer defaults or becomes insolvent.

Factoring vs. Bank Financing

While bank financing may come at a lower interest rate, factoring offers several unique advantages. Factoring is accessible even to startups and businesses without a long financial history, focusing on the quality of receivables instead of credit history.

Moreover, factoring companies often provide additional services like collections and credit checks, acting as an outsourced accounts receivable department. This can actually end up savings on costs if you can reduce staff on your team.

Choosing a Factoring Partner

Selecting the right factoring partner involves more than just considering rates. Here’s a handful of things to look for:

Longevity in the business

financial stability

transparency

service offerings

no hidden costs

check for references

The Road to Success with Factoring

Tina’s discussion highlighted a compelling success story of a two-truck operation growing to 450 trucks with the help of factoring. This demonstrates how, with the right partner and strategy, factoring can transform a business’s financial landscape, enabling growth and stability.

Download Our Rocket Recruiting Template

Easy 4 Step Roadmap To

Double Your Fleet in 2024