Helping Companies Hire The Best Drivers FAST... Guaranteed!

Take control of your perfect recruiting process to consistently grow your fleet without relying on crowded job boards or expensive recruitment agencies.

Helping Companies Hire The Best Drivers FAST... Guaranteed!

Take control of your perfect recruiting process to consistently grow your fleet without relying on crowded job boards or expensive recruitment agencies.

Download Our Rocket Recruiting Template

Easy 4 Step Roadmap To Double Your Fleet in 2024

Download Our Rocket Recruiting Template

Easy 4 Step Roadmap To

Double Your Fleet in 2024

Customers Who Use Us

Customers Who Use Us

Access The Entire

Driver Pool

No more relying only on the job boards. Easily access all the drivers in your market by launching ads in minutes that have been proven to work and generate over 80,000 leads.

"It's been just 1 week and we already have 4 interviewed drivers with confirmed interest including a lead driver with 7 others pending in the Savannah area."

Logan P.

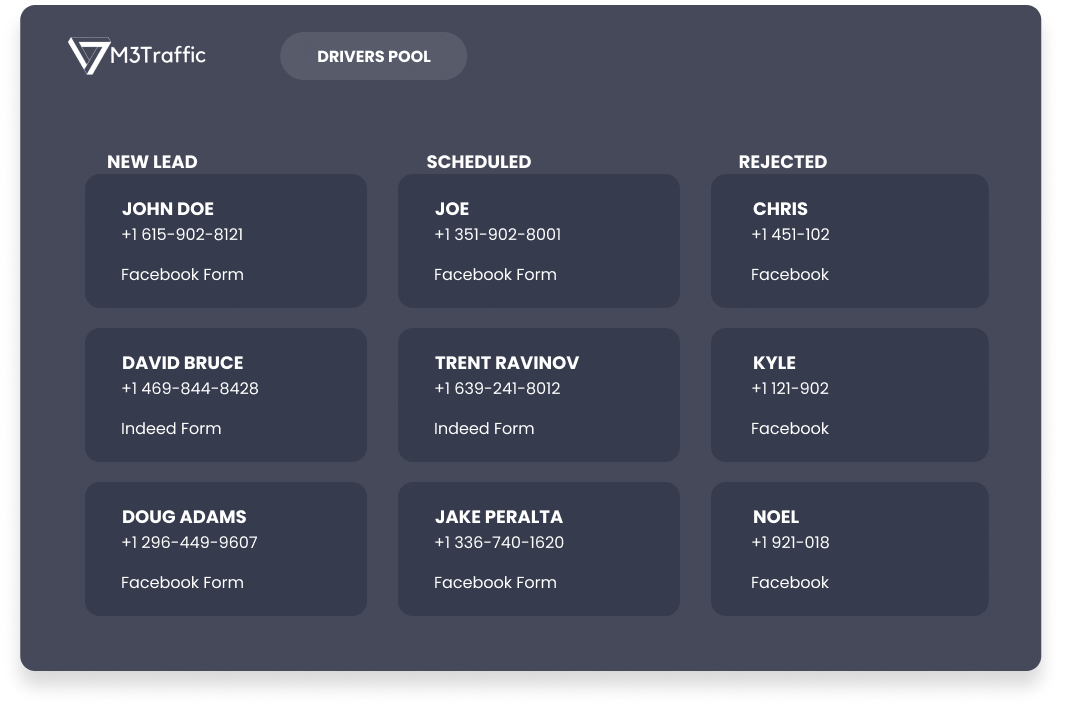

Save Time and Focus On Qualified Candidates

Reduce wasted time on unqualified candidates by filtering them out and instantly engage with your qualified candidates. The largest processor of driver applications did a study to find that you are 30% more likely to hire a driver if you respond within 5 minutes. Qualified applicants will show up on your calendar asking you to call them and give them an interview.

“With your system, it does it for us, making our job a little easier. We couldn’t keep up with all the candidates we have without your follow up system. Most of our tenured drivers are because of your follow up system."

Jasmynn F.

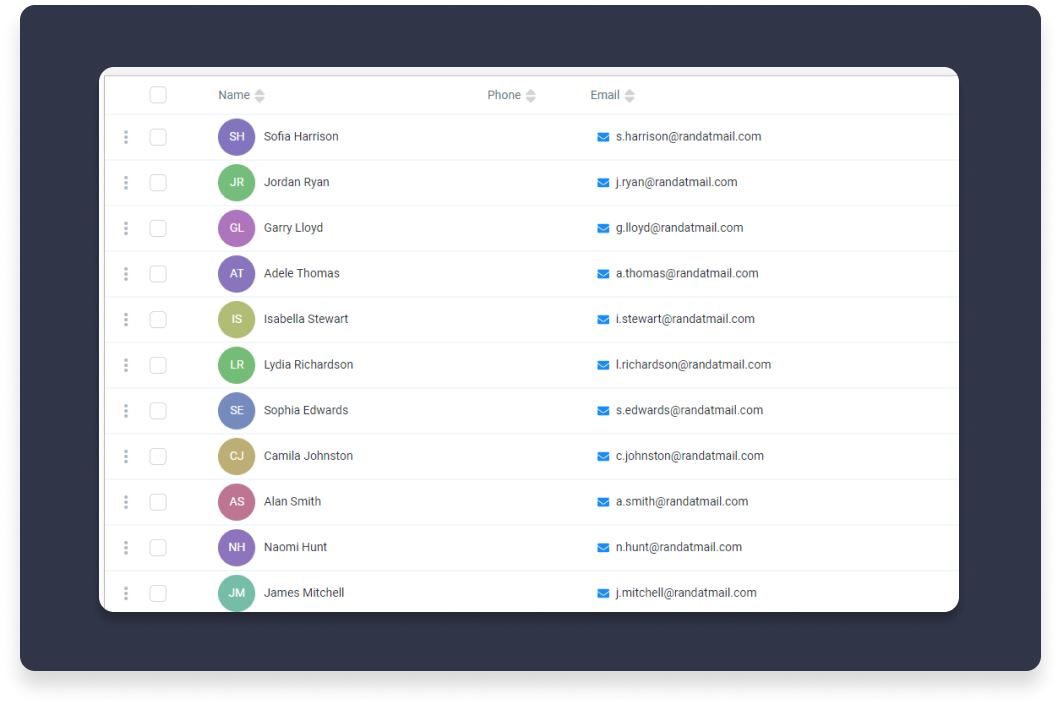

Lower Your Cost Per Hire by Building Your Waitlist

As the saying goes, fortune is in the followup.

By building your own company database of drivers and storing it in your system, you have permission to message them at will free of charge because you own this database. Next time you need to fill a position, use your own database rather than relying on someone else’s advertising platform or a crowded job board.

“Robert had a list of 300 drivers built up in his waiting list. Using ALIS, he sent out a message to them and had 25 interviews scheduled almost instantly for free and filled his position in 2 days. "

Access The Entire

Driver Pool

No more relying only on the job boards. Easily access all the drivers in your market by launching ads in minutes that have been proven to work and generate over 80,000 leads.

"It's been just 1 week and we already have 4 interviewed drivers with confirmed interest including a lead driver with 7 others pending in the Savannah area."

Logan P.

Save Time and Focus On Qualified Candidates

Reduce wasted time on unqualified candidates by filtering them out and instantly engage with your qualified candidates. The largest processor of driver applications did a study to find that you are 30% more likely to hire a driver if you respond within 5 minutes. Qualified applicants will show up on your calendar asking you to call them and give them an interview.

“With your system, it does it for us, making our job a little easier. We couldn’t keep up with all the candidates we have without your follow up system. Most of our tenured drivers are because of your follow up system."

Jasmynn F.

Lower Your Cost Per Hire by Building Your Waitlist

As the saying goes, fortune is in the followup.

By building your own company database of drivers and storing it in your system, you have permission to message them at will free of charge because you own this database. Next time you need to fill a position, use your own database rather than relying on someone else’s advertising platform or a crowded job board.

“Robert had a list of 300 drivers built up in his waiting list. Using ALIS, he sent out a message to them and had 25 interviews scheduled almost instantly for free and filled his position in 2 days. "

Join the One Driver Away Challenge Today!

Ready to hire your next great driver? Take the challenge for only $99 – Pay once, and get lifetime access to the proven system that will help you recruit drivers quickly and efficiently. No more guesswork, no more wasted time.

Latest Blog Posts

How to Get Paid to Hire Employees

How to Get Paid to Hire Employees

Introduction

Hiring new employees is a major expense for any business. But what if you could actually get paid to hire certain employees? It’s not a dream—it’s a real opportunity known as the Work Opportunity Tax Credit (WOTC).

In a recent discussion with Marcy Alfrejd, an expert in this field, we explored how employers can take advantage of this federal tax credit to offset the costs of onboarding new employees. Here’s what you need to know.

What is the Work Opportunity Tax Credit (WOTC)?

The Work Opportunity Tax Credit is a federal tax credit available to employers for hiring individuals from specific targeted groups who face significant barriers to employment. You can find a complete list of groups on the IRS website.

Substantial Financial Benefits

From Marcy’s experience, she has seen an average of $800 credit per employee that qualifies. In one case, she saw an employer receive the max of $9,600 for someone they hired.

High Turnover Industries Benefit More

This is a huge opportunity for logistics companies specifically because this is an industry with high turnover rates. Since you are constantly recruiting and onboarding new staff, the potential for tax credits accumulates quickly.

Streamlined Application Process

The process to find out if you qualify for these credits is straightforward, though the paperwork can initially seem overwhelming. Employers can ease this burden by using services offered by payroll companies, like Paychex, which aid in the application process.

Steps to Maximize Your Benefits

Always Apply - as you might guess, employees may not always disclose their eligibility. So, Marcy’s advice is to apply for the credit for every new hire. Better to over-apply than miss out on potential credits.

Use IRS Resources - The IRS website has a comprehensive guide on WOTC, including targeted group descriptions and the application process. The form to apply is IRS form 8850.

Leverage Professional Services - Employers can benefit from collaborating with CPAs or payroll companies that handle WOTC applications. These professionals ensure that you comply with IRS guidelines, making the process smoother.

Conclusion

Incorporating these strategies can significantly lower your cost per hire by ensuring more applicants complete their applications. Making your forms mobile-friendly, following up methodically, and engaging with potential hires before asking them to complete lengthy forms can make a huge difference.

Happy hiring!

Latest Blog Posts

How to Get Paid to Hire Employees

How to Get Paid to Hire Employees

Introduction

Hiring new employees is a major expense for any business. But what if you could actually get paid to hire certain employees? It’s not a dream—it’s a real opportunity known as the Work Opportunity Tax Credit (WOTC).

In a recent discussion with Marcy Alfrejd, an expert in this field, we explored how employers can take advantage of this federal tax credit to offset the costs of onboarding new employees. Here’s what you need to know.

What is the Work Opportunity Tax Credit (WOTC)?

The Work Opportunity Tax Credit is a federal tax credit available to employers for hiring individuals from specific targeted groups who face significant barriers to employment. You can find a complete list of groups on the IRS website.

Substantial Financial Benefits

From Marcy’s experience, she has seen an average of $800 credit per employee that qualifies. In one case, she saw an employer receive the max of $9,600 for someone they hired.

High Turnover Industries Benefit More

This is a huge opportunity for logistics companies specifically because this is an industry with high turnover rates. Since you are constantly recruiting and onboarding new staff, the potential for tax credits accumulates quickly.

Streamlined Application Process

The process to find out if you qualify for these credits is straightforward, though the paperwork can initially seem overwhelming. Employers can ease this burden by using services offered by payroll companies, like Paychex, which aid in the application process.

Steps to Maximize Your Benefits

Always Apply - as you might guess, employees may not always disclose their eligibility. So, Marcy’s advice is to apply for the credit for every new hire. Better to over-apply than miss out on potential credits.

Use IRS Resources - The IRS website has a comprehensive guide on WOTC, including targeted group descriptions and the application process. The form to apply is IRS form 8850.

Leverage Professional Services - Employers can benefit from collaborating with CPAs or payroll companies that handle WOTC applications. These professionals ensure that you comply with IRS guidelines, making the process smoother.

Conclusion

Incorporating these strategies can significantly lower your cost per hire by ensuring more applicants complete their applications. Making your forms mobile-friendly, following up methodically, and engaging with potential hires before asking them to complete lengthy forms can make a huge difference.

Happy hiring!

Download Our Rocket Recruiting Template

Easy 4 Step Roadmap To

Double Your Fleet in 2024